Peoria County Real Estate Records

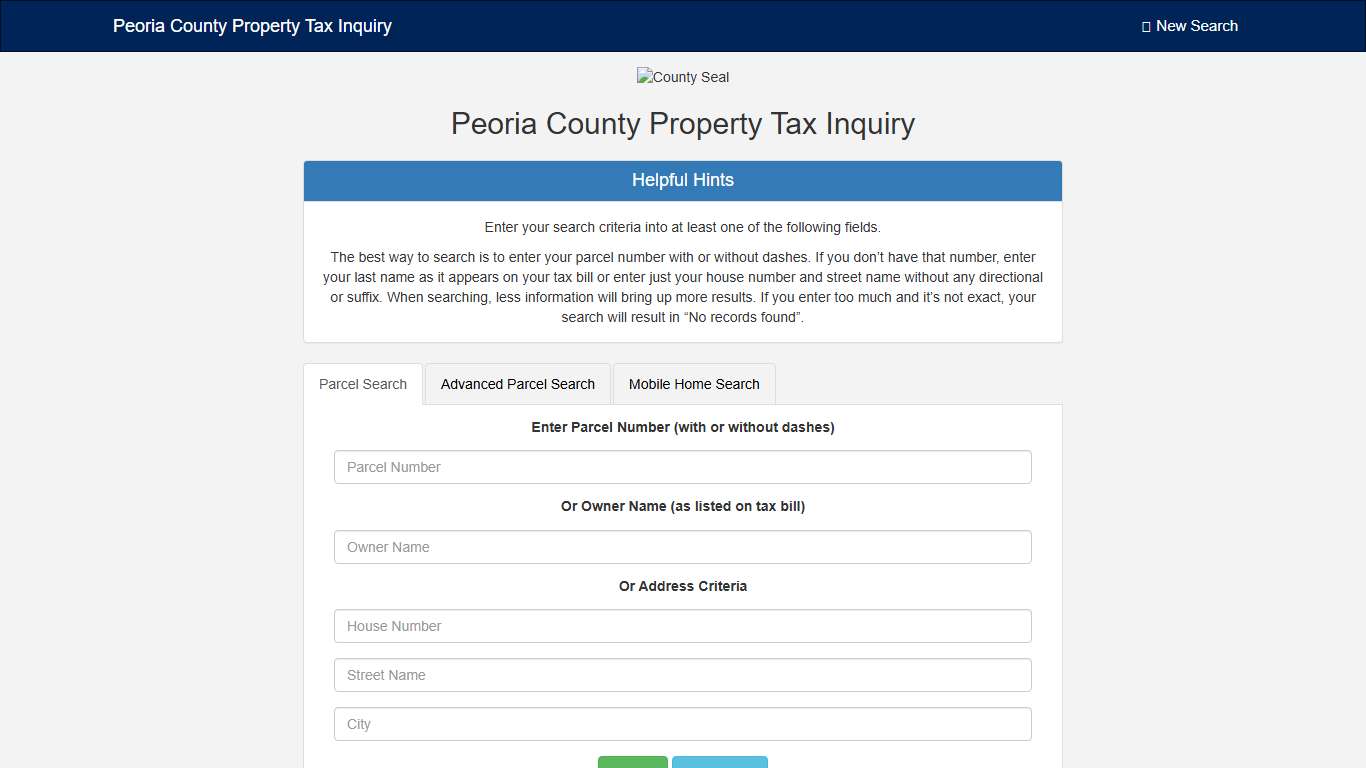

Peoria County Property Tax Inquiry

Peoria County Property Tax Inquiry Helpful Hints Enter your search criteria into at least one of the following fields. The best way to search is to enter your parcel number with or without dashes. If you don’t have that number, enter your last name as it appears on your tax bill or enter just your house number and street name without any directional or suffix.

https://propertytax.peoriacounty.gov/

Search Peoria County Public Property Records Online

CourthouseDirect.com Notifications (Last Updated: 1/7/2026 2:31:00 PM CST) ... Peoria County Assessor's Records w/ Document I. D. #'s ...

https://www.courthousedirect.com/PropertySearch/Illinois/PeoriaResidential Property Registration | Peoria, IL

Residential Property Registration 2026-2027 Non-Owner Occupied Registration is now Open! Visit our 2026-2027 Registration Page for more information! Non-Owner Occupied Property Registration Who must register? Any property within Peoria city limits that is: Rented to tenants, OR Vacant for 6 months or more When to Register Renewals: Every year by February 28 New properties: Within 30 days after closing Register Your Property: Non-Owner Occupied...

https://www.peoriagov.org/273/Residential-Property-Registration

Peoria County Property Records | Owners, Deeds, Permits

Instant Access to Peoria County, IL Property Records - Owner(s) - Deed Records - Loans & Liens - Values - Taxes - Building Permits - Purchase History - Property Details - And More! Peoria County, Illinois, encompasses 15 municipalities, which include cities and villages.

https://illinois.propertychecker.com/peoria-county

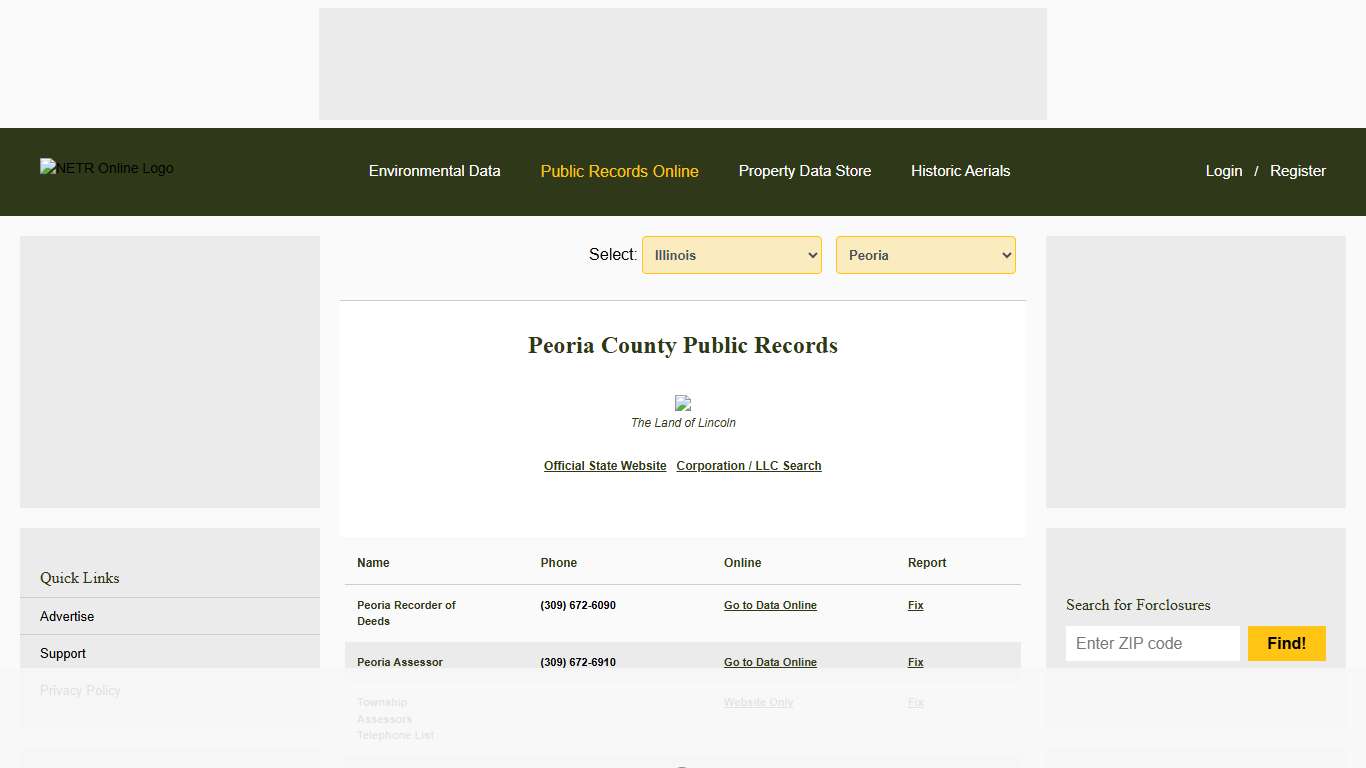

NETR Online • Peoria • Peoria Public Records, Search Peoria Records, Peoria Property Tax, Illinois Property Search, Illinois Assessor

Select: Peoria County Public Records The Land of Lincoln Peoria Recorder of Deeds (309) 672-6090 Peoria Assessor (309) 672-6910 Township Assessors Telephone List Peoria Treasurer (309) 672-6065 Peoria NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/IL/county/peoria

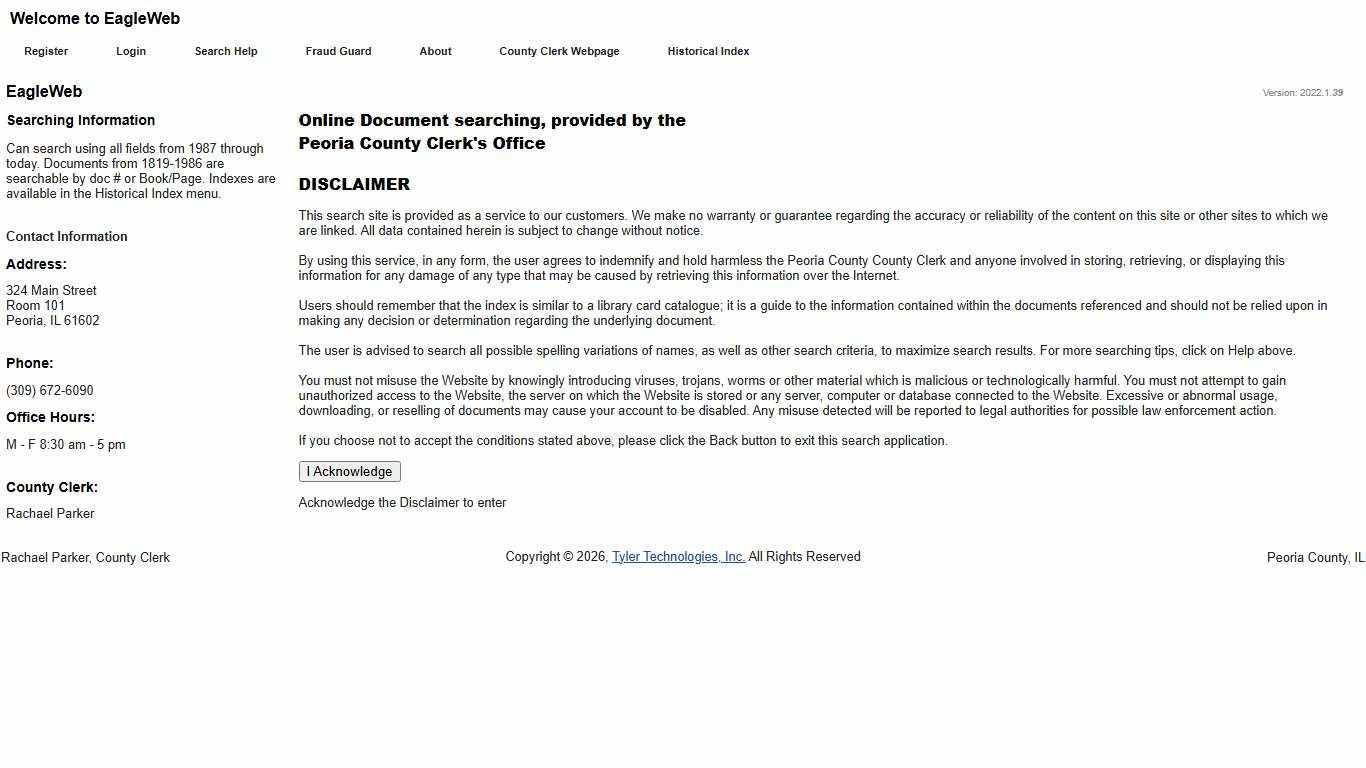

Peoria County - Disclaimer

Version: 2022.1.39 Online Document searching, provided by the Peoria County Clerk's Office DISCLAIMER This search site is provided as a service to our customers. We make no warranty or guarantee regarding the accuracy or reliability of the content on this site or other sites to which we are linked.

https://recorder.peoriacounty.gov/recorder/web/

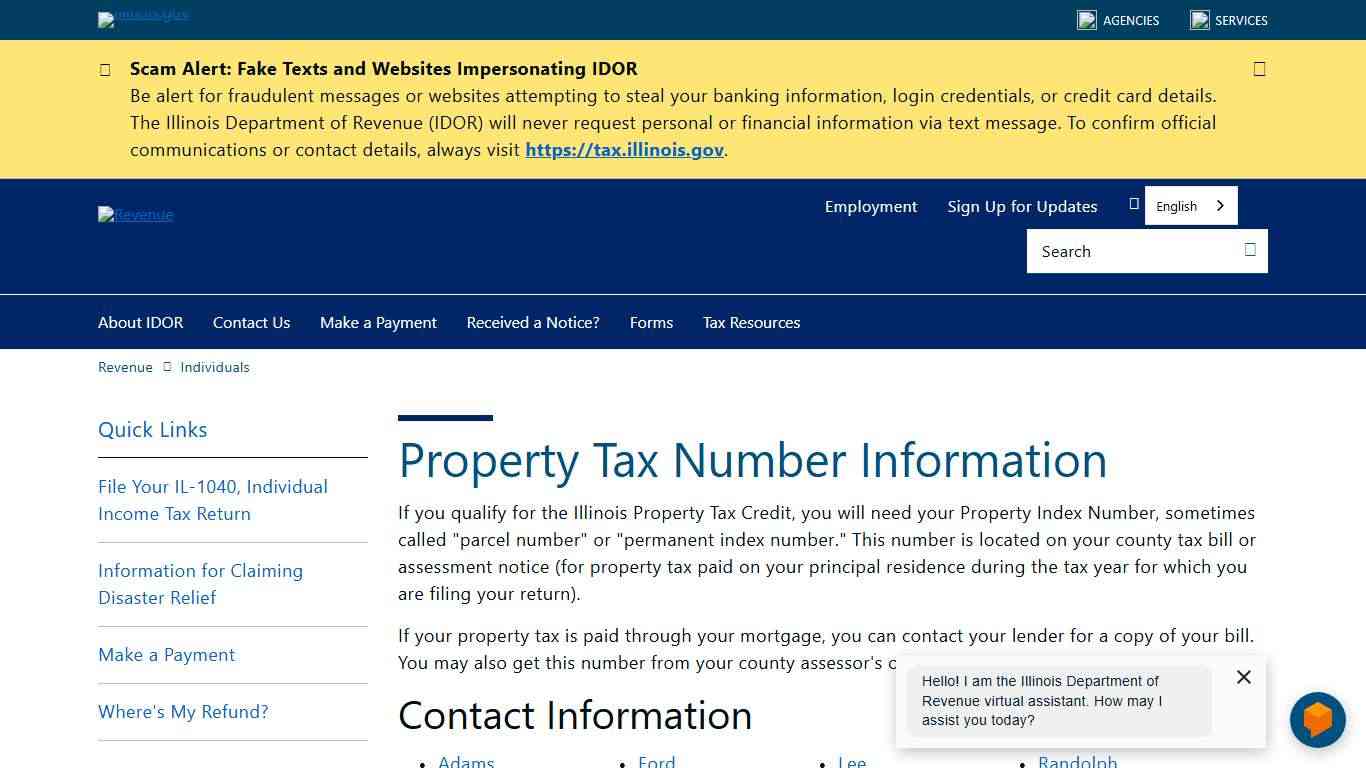

Property Tax Number Information

Property Tax Number Information If you qualify for the Illinois Property Tax Credit, you will need your Property Index Number, sometimes called "parcel number" or "permanent index number." This number is located on your county tax bill or assessment notice (for property tax paid on your principal residence during the tax year for which you are filing your return).

https://tax.illinois.gov/individuals/illinoiscounties.html

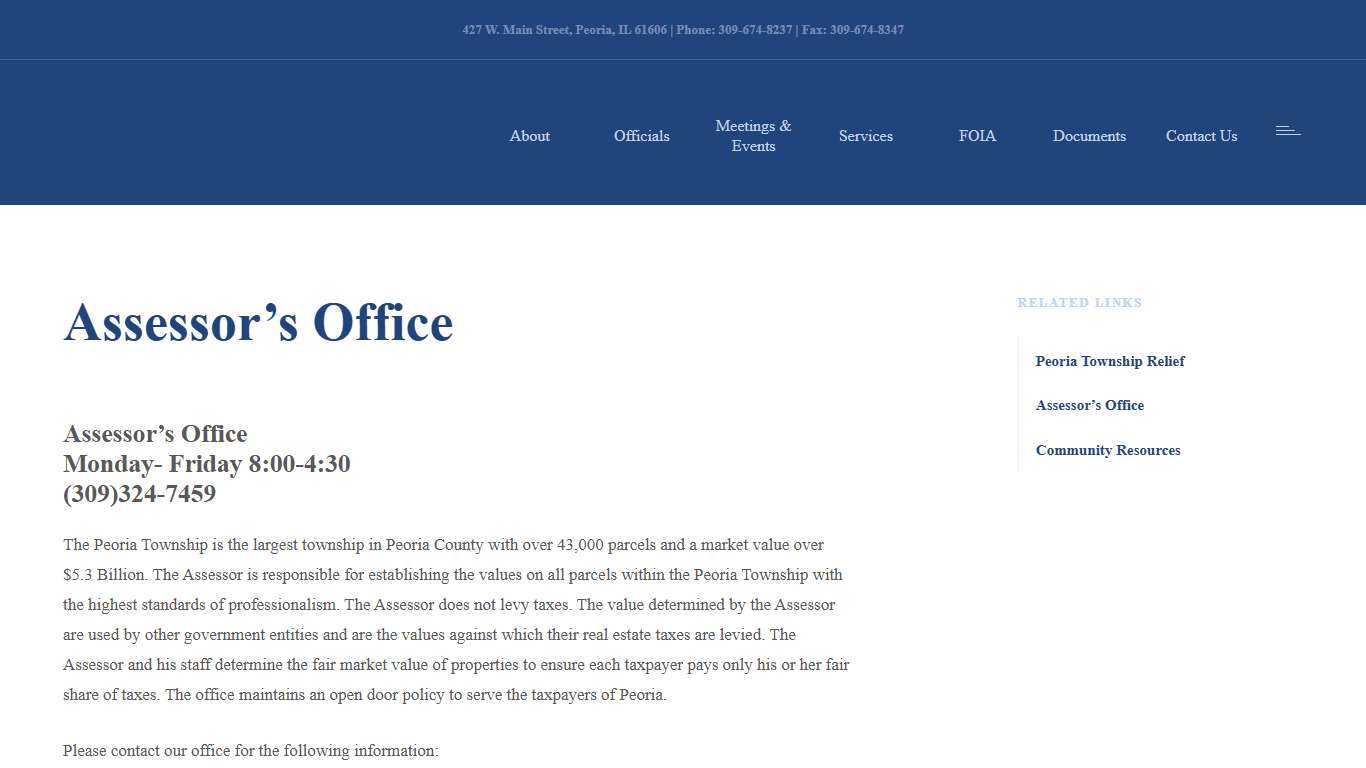

Assessor’s Office – City of Peoria Township

Assessor’s Office Monday- Friday 8:00-4:30 (309)324-7459 The Peoria Township is the largest township in Peoria County with over 43,000 parcels and a market value over $5.3 Billion. The Assessor is responsible for establishing the values on all parcels within the Peoria Township with the highest standards of professionalism.

https://peoriatownshipil.com/services/town-collector/

Peoria County GIS

GIS technology aids decision making by providing data visualization, real-time data collection, access to data and analytics, open data, cartographic maps, interactive applications, and more. Peoria County GIS provides a variety of services and support for county departments and the community.

https://data-peoriacountygis.opendata.arcgis.com/

Peoria County funds jail upgrades with level tax rate in $174 million budget | WCBU Peoria

Peoria County is keeping its property tax rate the same for 2026, but will still bring an about $2 million more through increased taxable land values. The county’s $174.2 million budget for 2026, which the county board adopted Thursday, devotes $31.7 million in capital projects, including $3.5 million in pre-construction services for Peoria County Jail upgrades.

https://www.wcbu.org/local-news/2025-11-14/peoria-county-funds-jail-upgrades-with-level-tax-rate-in-174-million-budget

Peoria County Recorder Information, Illinois - Deeds.com

Recorder of Deeds County Courthouse - 324 Main St, Room 101, Peoria, Illinois 61602 Office Hours: Monday–Friday 8:30am–5:00pm / Recording Hours: Monday–Friday 8:30am–4:30pm (309) 672-6090 About the Peoria County Recorder's Office The County Clerk and Recorder is responsible for maintaining property records in Peoria County.

https://www.deeds.com/recorder/illinois/peoria/

Proposed property tax levy increase could cost Peoria homeowners more

PEORIA (25News Now) - Although Peoria’s property tax rate is expected to stay the same for the year, city leaders are once again considering raising the total property tax levy. During a special city council meeting on Tuesday night, council members heard the proposed tax levy, which would draw in tax revenue based on an around 6.5% increase in home values.

https://www.25newsnow.com/2025/10/01/proposed-property-tax-levy-increase-could-cost-peoria-homeowners-more/

The final day to pay 2024 Real... - Peoria County Government | Facebook

The final day to pay 2024 Real Estate Taxes (due in 2025) before going to tax sale is November 7, 2025 at 5 p.m. The tax sale will be held on November 10, 2025 at 9 a.m. The last day for registration as a tax buyer for the tax sale is October 27, 2025.

https://www.facebook.com/peoriacountygov/posts/the-final-day-to-pay-2024-real-estate-taxes-due-in-2025-before-going-to-tax-sale/1287478853420884/